The dotcom bubble frenzy of the late 1990s was an unexpected precursor to tech businesses reigning over the present-day public markets. Out of the top ten most valued companies in the world, an astonishing seven companies belong to tech — most which continue to innovate.

Technological innovation is often a result of shifting landscapes, wherein the COVID-19 pandemic represented a tectonic rift across all domains of life. Education, an omnipresent human endeavor, leveraged technology as a mediator to reach the masses when cities went into lockdowns.

Opportune Times

The investment thesis for EdTech companies is simple — access to a large mass of learners through the modernization of the education system brought about by the pandemic. Capital is flowing into the sector at record levels to exploit the changing views that organized learning happens best in a brick-and-mortar setting. Consequently, the increased use of EdTech has presented private investors with a golden opportunity to cash out amidst growing retail interest, both on the consumer side as well as the investment side.

A Handful of Listed EdTech Companies Are Riding the Manic Wave

Coursera’s IPO is a testament to the burgeoning interest in the EdTech sector. The company, which was able to raise $519 million through the IPO, has a market cap of $5.8 billion. The IPO meant that the company’s valuation rose two-fold to its current market cap, wherein earlier it was valued at $2.6 billion post a $130 million fundraise in mid-2020. Additionally, the MOOC (Massive Open Online Course) provider is one of the more expensive companies in terms of its EV (Enterprise Value) multiples, with its EV/Revenue standing at 5.9x.

Coursera’s IPO came after an attractive 2020 performance:

- Coursera’s revenue increased by 59% to $293.5m in 2020, while its losses increased to $66.8m, up from $46.7m in 2019

- Half of the 2020 consumer revenue came from users registered before the pandemic, i.e. 2019

- Revenue mix has improved as their Consumer segment represented 65% of the revenue in 2020 but 90% in 2017

Although Coursera’s IPO represents a major, post-pandemic exit, there are other EdTech securities which have benefitted from the surge in the use of their products.

Chegg, an online subscription service that enables students to rent or buy books, access textbook solutions and online tutoring, amongst others, has seen its share price surge by over 140% from pre-pandemic levels. Given the impressive share price appreciation, its valuations are lofty as well. It is currently trading at high EV/Revenue and EV/EBITDA multiples of 19.9x and 61.9x, respectively. Such valuations can be attributed to high 5-year revenue CAGR of 39%, a large subscriber base of 3.9million (Y/Y growth of 67%) and the fact that it is closing in on profitability, in addition to the industry tailwinds. Although, the company faces the risk of a highly price sensitive consumer base (i.e. college students) and the possibility of fraud, wherein a paid user can share answers/material with a host of others.

Other consumer-facing platforms such as Stride tell a similar story (although not as drastic as Chegg). Stride is an online K-12 education provider which also offers college-prep programs and a growing segment of specialized professional training courses. The company’s stock has increased by around 45% since the beginning of 2020 while current valuations remain attractive at an EV/Revenue of 4x and EV/EBITDA of 11.9x.

Likewise, B2B and B2B2C companies are benefitting from the surge as well. Stocks of companies such as 2U Inc., Learning Technologies Group, Tribal Group and 3P Learning have all soared, and hence valuation multiples seem to be expensive.

Why the Hype?

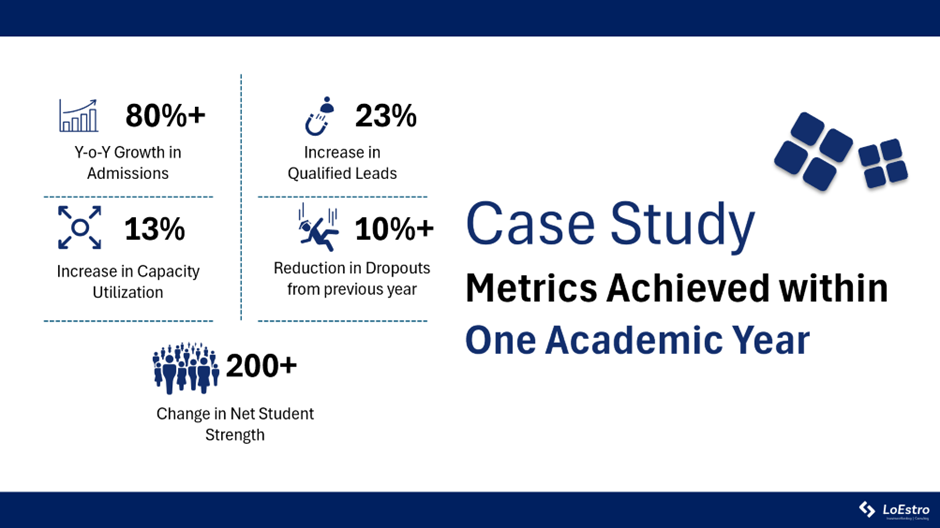

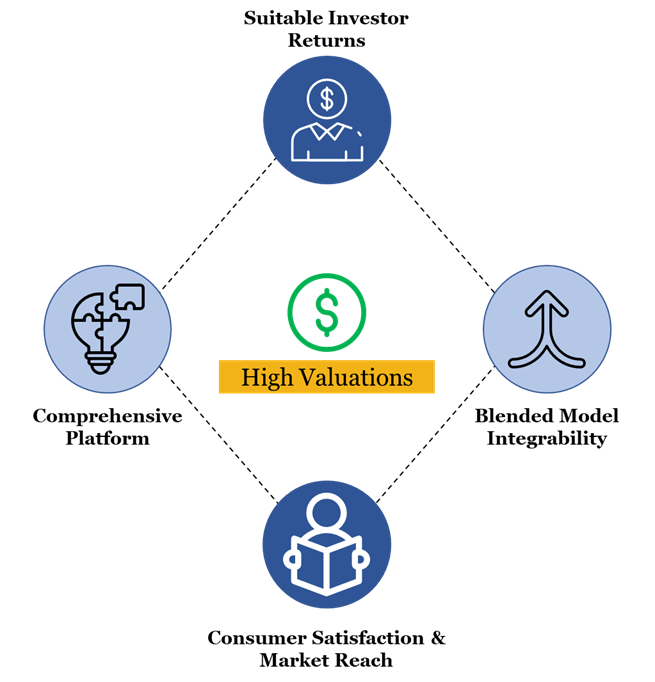

Two themes that stand out amongst EdTech companies with expensive valuations and those that have experienced notable share price jumps are: (i) the comprehensiveness of the platforms, and (ii) their role in a hybrid/blended model of education.

Comprehensive platforms which provide a multitude of complimentary service offerings prove to be an attractive bet for customers, especially in a space which is largely fragmented but dominated by a few large players. This is especially true for consumer facing businesses, wherein consumers might not have the bandwidth to assess different companies which provide a singular service offering, when the consumer wants to use multiple services. On the other hand, companies also benefit from economies of scale when they offer a complimentary service mix.

As lockdowns forced learners to stay away from brick-and-mortar schools, EdTech companies experienced a surge in users. Although, students are going back to school as economies open up — which will not change soon, given that the physical mode of learning has been the preferred mode of learning for centuries. It is becoming increasingly clear that virtual classrooms will not replace physical classrooms but have a clear ability to enhance student experience and outcomes. The ability of EdTech companies to integrate their service mix inside a hybrid/blended learning ecosystem will define their success.

Other Companies Waiting to Cash In

A number of private companies fulfil the above two “success factors”, some of which are said to go public in 2021, such as Udemy, Nerdy, Zouyebang and Duolingo. However, the list is much longer than that, given that the markets are ripe for such companies to go public — valuations high enough for satisfactory investor exits, ease of listings through SPAC (especially the introduction of EdTech focused SPACs) and industry tailwinds.

The Indian Context

Byju’s, one of the two Indian EdTech unicorns, plans to go public in the next 2 years. The Indian market represents one of the largest opportunities for EdTech companies across the globe. Indian EdTech startups have attracted a large amount of private capital to fund the growth that is required to tap into a behemoth opportunity, which is expected to be worth $30 billion by 2030.

On a broader level, consumer tech in India has followed a steep growth trajectory over the last decade. Startups such as Zomato and Nykaa have become household names and leaders in their categories, and plan to issue IPOs of their own soon. Such IPOs are expected to generate a lot of buzz, which they have, despite heavy losses as in the case of Zomato. Such market sentiment could potentially favor the Byju’s IPO.

As the Indian EdTech experiences consolidation, a larger number of Indian startups will move towards an emulation of what has been observed in developed public markets. A handful of companies will eventually become comprehensive platforms and would have to synergistically integrate with physical classrooms as the economy opens up. The two EdTech unicorns of India, Byju’s and Unacademy, already fulfill those characteristics, and are expected to command high valuations should they go public. Additionally, country-specific tailwinds such as the adoption of the NEP, and a large TAM and population make the Indian market even more interesting.

As with any upcoming tech field, investors might be rightly concerned about the high valuations and the uncertainty associated with startups. However, it is becoming increasingly clear that EdTech is here to stay in a post-pandemic world.

Watch this space for more on EdTech, Education, and everything in between.