This Week in Deals — January to March 2023

This Week in Deals — January to March 2023

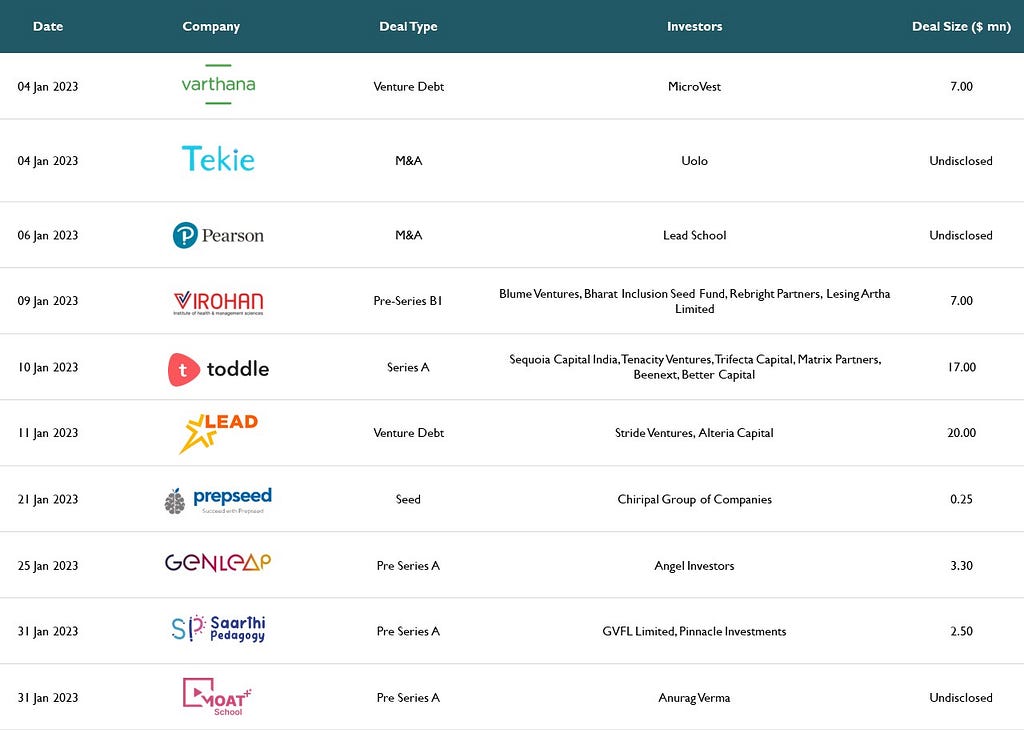

Between January 1, 2022 and March 31, 2023, we saw 15 companies in the Indian Education ecosystem getting funded or acquired. The companies came from spaces such as FinTech, UpSkilling, SaaS, and K-12.

Who Got a Slice?

Varthana (Venture Debt, $7 Million): Varthana is a loan provider which provides financial support to affordable private schools in India. The financing was raised from MicroVest.Tekie (M&A, Undisclosed): Tekie is a live coding platform that used animated series and content to teach coding to young students. The company was acquired by Uolo in an all stock deal.Pearson India K-12 (M&A, Undisclosed): Pearson India offers blended learning solutions for English Medium Schools. The company was acquired by Lead School for an undisclosed amount.Virohan (Pre-Series B1, $7 Million): Virohan is an edtech company that offers blended upskilling programmes for paramedical aspirants such as medical technicians and administration. The round was led by Blume Ventures, along with participation from Bharat Inclusion Seed Fund, Rebright Partners, and Lesing Artha Limited.Toddle (Series A, $17 Million): Toddle is an LMS designed for independent schools offering IB, UbD, Cambridge, British, and other curricula. The Series A funding was led by Sequoia Capital India. Tenacity Ventures and Trifecta Capital along with existing investors Matrix Partners, Beenext, and Better Capital also participated.Lead School (Venture Debt, $20 Million): Lead School is a provider of integrated learning solutions for affordable private schools in India. The company raised a venture debt round from Stride Ventures and Alteria Capital .PrepSeed (Seed, $250K): Prepseed is an online platform that provides test-preparation material for JEE, NEET, SAT, CBSE, and Cambridge. The seed round was raised from Chiripal Group of Companies.Genleap (Pre Series A, $3.3 Million): GENLEAP is a DNA-based self-discovery, upskilling and employability platform. The company raised a pre-series A round was a set of angel investors.Saarthi Pedagogy (Pre Series A, $2.5 Million): Saarthi Pedagogy offers a platform academic content (Textbook, worksheet, academic publications), learning management system, and PPAP rote-free pedagogy, for K-12 schools. Saarthi raised INR 10 crore from GVFL Limited to wrap up its INR 30 crore pre-Series A round, with participation from Pinnacle Investments.Moat School (Pre Series A, Undisclosed): Tech upskilling platform designed for students and early professionals. The undisclosed round was raised from Anurag Verma.BlueLearn (Seed, $3.5 Million): Bluelearn is a platform designed for college students and early professionals, helping them upskill and find jobs. The seed round was led by Elevation Capital and Lightspeed Venture Partners.NxtWave (Series A, $33 Million): NxtWave offers vernacular, asynchronous & online coding programs for college students, graduates and early professionals. The $33 million Series A round was led by Greater Pacific Capital (GPC), with participation from Orios Venture Partners.Admitkard (Series A, $6 Million): AdmitKard is a platform that offers study abroad solutions, such as counselling, test prep material, mentor guidance and financing. The company raised a $6 million round which was led by GSV Ventures.Knowledge Planet (M&A, Undisclosed): Knowledge Planet offers test-prep courses across competitive examinations such as JEE and NEET. The company was acquired by PhysicsWallah in an undisclosed deal, marking PW’s first international foray.upGrad (Rights Issue, $25 Million): upGrad is India’s largest online higher education company providing programs in Data Science, Technology, Management and Law, to students, working professionals and enterprises. The company completed an internal rights issue of Rs 300 crore from existing shareholders Ronnie Screwvala and Temasek.

Watch this space for more on Education, EdTech, and everything in between.

This Week in Deals — January to March 2023 was originally published in LoEstro Advisors on Medium, where people are continuing the conversation by highlighting and responding to this story.